Military Benefits Texas - Texas Military Distinguished License Plates: Distinguished Soldiers are eligible for the United States Texas Distinguished License Plate. Applicants must provide official documentation that they have been honorably discharged from the US Army. This meal can be customized for a fee of $40.

Texas Department of Transportation Request for Assistance Armed Forces Coast Guard Merchant Marine and Civil Aviation Patrol License Plate Form VTR-424 Texas Hazlewood Law Tuition Fee Waiver: Texas Hazlewood Law Provides Eligible Veterans with Adequate Property, Tuition Waiver'

Military Benefits Texas

Source: s3.us-west-2.amazonaws.com

Source: s3.us-west-2.amazonaws.com

the majority of fees up to 150 credit hours in public higher education institutions. This does not include living costs, books or supplies. Who Eligible for Hazlewood Texas Tuition Fees Exempt Benefit: Veterans must meet the following requirements: All vehicles registered in Texas must operate on public roads (unless

Annual Vehicle Safety Inspection

excepted by law) must pass an annual safety inspection. Vehicles must have current checks and pass prior to registration. You will need to submit proof of valid liability insurance to receive your vehicle inspection report. Some areas also have emissions testing requirements.

Check with your state for requirements. Texas Hilton Honors Military Program: The Texas Hilton Honors military program makes the transition from service in the United States Armed Forces to civilian employment easier for current and former members of the armed forces.

The Hilton Honors Military Program will provide hotel accommodations for travel needs while they search for a new job, train for a new job or find a home. Eligible people can earn up to 100,000 hotel points for verifiable work-related activities.

Each state determines its own rights and residency requirements. Recipients must have a Hilton Honors account to earn points. For more information, email HiltonHonors@naswa.org or contact the nearest American Job Center. Note: You may be eligible for Fry Scholarships and the DEA program, but you can only use one.

Source: images.squarespace-cdn.com

Source: images.squarespace-cdn.com

The “Texas Income Tax Break”

You will have to choose one when you apply. Once you have made this decision, you cannot switch to another application. Institutions of higher education will award undergraduate students CREDIT for all physical education courses required by the institution for a bachelor's degree and for additional semester credit, which may be applied to satisfy any elective course requirements for the student's degree program on

for Courses outside. Student or parent if student: All veterans are encouraged to complete the Texas Veterans Cemetery pre-registration form to establish eligibility prior to need. For questions and more information, call 800-252-VETS (8387). Texas Federal and Texas Veterans Commission, Spouse and Dependent Burial Benefits (Burial of dependent children is limited to unmarried children under the age of 21 or 23 if full-time students at Approved educational institutions or children who develop a lifelong disability

before the age of 21) Since Texas has no personal income tax, military members who live there will enjoy more savings when they pay more taxes than they do in states where personal income tax is collected.

There is also no tax on Texas military retirement income. Gulf Campaign Holders or Gulf War Veterans who first enlisted after September 7, 1980 (or who entered active duty on or after October 14, 1982 and have not yet completed active duty 24 months earlier) must serve

Transfer Of Plates

continuously for 24 months or full time as called or ordered to perform active duty. The 24 month service requirement does not apply to veterans who are eligible for 10 points allocated for a disability occurring or aggravated in the line of duty, or to veterans who have been

separation due to difficulties or other reasons under Section 10 U.S.C. 1171 or 1173. The Hazelwood Inheritance Act is available to eligible foster children. Veterans transfer unused or remaining Hazelwood Act study hours to those responsible.

Source: d1ldvf68ux039x.cloudfront.net

Source: d1ldvf68ux039x.cloudfront.net

Since 2011, conditions have been requiring veterans to live in Texas during the time you are in charge. Only one dependent can use these hours at a time. You can transfer your military license plate to a new vehicle, but be sure to notify your vehicle dealer and/or county tax assessor so your vehicle registration record can be updated.

You may be asked to confirm whether the license plate number is a designated "first set" or an additional set of license plates due to different registration fees. You should not assume that all local and state parking will be free.

We Value Your Feedback

Please be aware that some private and local government parking garages (for example, airports) are subject to local regulations and may not waive Parking fees in certain situations. Some federal equipment requires an ISA, either on a plate or a disability label to be displayed.

Free Withdrawal Recording for Texas Veterans: All county clerks in the county are required to record a free official issuance document (DD214) of veterans serving in the United States Armed Forces in America. Guard/Reserve members may be eligible if they have resumed active duty service for at least 180 days on or after November 25, 2015 “and have received a separate DD-214 form or have served at least 90 days of active duty resume services.

"Began on or before November 24, 2015 as a reservist or member of the National Guard and received a DD-214 form at the time of separation." Texas VLB Home Improvement Loans: Home Improvement Loans VLB offers below-market rate loans for home remodeling and home remodeling.

VLB offers loans of up to $50,000 for 2 to 20 years or loans of $7,500 to $10,000 for 2 to 10 years. Veterans with a VA service-connected disability rate of 30% or more are eligible for a reduced interest rate.

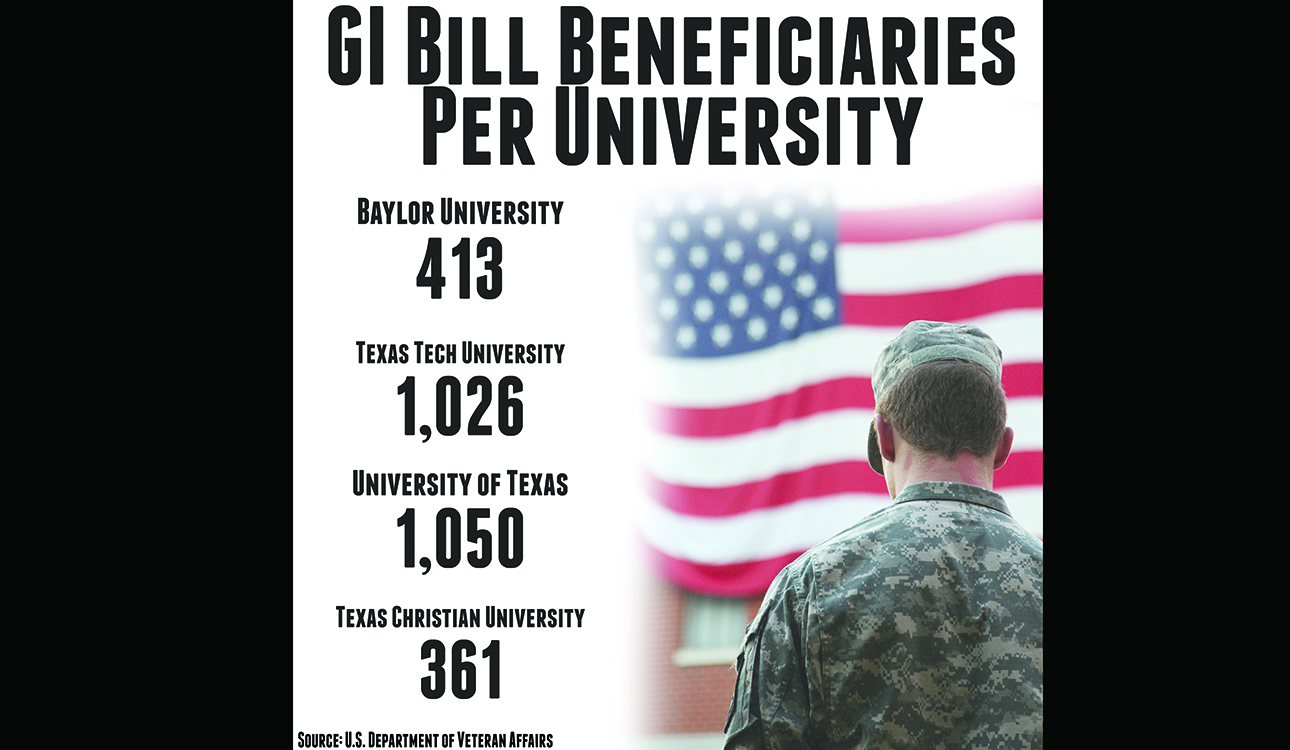

Source: baylorlariat.com

Source: baylorlariat.com

Veterans Land Board

Your message will go to our website group. Thank you for helping us serve you better! If you would like to contact a specific department and receive a response, please visit our About Us page. If you are a Texas resident and have not previously paid Texas sales tax, you will pay 6.25% sales tax or the difference between the full amount of the tax less the amount previously paid to the state

another. For used vehicles, the price of the vehicle will be determined locally and based on the standard value (SPV) of the vehicle. The SPV calculator is available on our homepage for your information. Information can be obtained by calling (800) 252-1382 or by visiting www.window.state.tx.us.

Texas Badges of Honor: Army Medal of Honor recipients are eligible for a free Texas Badge of Honor. Applicants must provide a written application with a copy of their DD214 or a copy of their award certificate to: The heirs will be exempted for the specified number of certification hours.

The maximum number of hours earned depends on the degree or certification program and should be within the normal time period to complete their degree or certification. If you live at US Marine Corps Base Camp Lejeune or Marine Corps Air Station (MCAS) in North Carolina with an active duty veteran who is your spouse or parent for at least 30 days in

If You Disagree With Dd Form

successively from August 1953 to December 1987 You may have been exposed to contaminants in drinking water there. Scientific and medical evidence suggests a link between exposure to these toxins and the later development of certain diseases.

If you have any of the conditions in question now, you may be eligible for VA health care benefits. Texas Homestead Tax Exemption for 100% Disabled or Unemployed Veterans: The Texas property tax is a locally assessed and administered tax.

Source: d2e70e9yced57e.cloudfront.net

Source: d2e70e9yced57e.cloudfront.net

There is no state property tax. The Texas Property Tax Exemption Comptroller publication provides a brief summary of the property tax exemptions available. The Veterans Land Board (VLB) provides Texas direct loans to qualified veterans. Up to $150,000 can be earned per transaction "to buy land at competitive interest rates", according to VLB's official website.

If you do not agree with the information on your DD 214 form that prevents us from using your military pay to receive benefits, you can apply to your service branch to change the information on the DD 214 Form. To apply for a change,

Help From The Texas Veterans Commission

submit Form DD 149, Ministry of Defense Request to Correct Military Records to the appropriate address on the back of the form. You can download Form DD 149 from the National Archives website or get it from your local Workforce Solutions office.

Texas Department of Military Awards: Texas honors 33 state awards honoring the service, performance, or achievement of veterans and retired service members. A brief description of some of these awards is given below. Employees who are unable to perform their former duties because of a disability related to the services they received while serving in the Armed Forces of the United States must be employed for work they can perform, and have the status, status and

similar salary. Previous site. TLTV is a joint effort with local bar associations, legal aid organizations and veterans to provide legal advice clinics across the state. Texas State Bars TLTV Online Contacts Event Calendar If you are a Texas resident serving out of state, you can keep your job in Texas and resume your registration.

If you have a Texas title, you must keep your registration accurate and current. TVC is authorized to manage funds and make compensation to address the needs of veterans and their families as determined by the Veterans Needs Assessment Study.

Source: baylorlariat.com

Free Or Reduced-Price Texas Handgun Licenses

All promotions are made through a competitive grant selection process. Your vehicle must meet the Federal Motor Vehicle Safety Standards (FMVSS) established by the National Highway Traffic Safety Administration. More information on customs duties or other matters can be found at US Customs and Border Protection.

There are also indirect benefits. The Texas Veterans Commission provides general assistance to agencies dedicated to assisting veterans. Similar assistance is available to approved agencies for mental health, "Court of Justice" assistance, and the "Housing for Texas Heroes" program.

Note: In some cases, you may receive benefits and other employment and education services for your dependents. For example, you may qualify if you are the child of a Vietnam or Korean war veteran and have a certain congenital disability or if you are a dependent child or spouse of a deceased or permanently disabled veteran who is totally disabled as a result

. of active service. 10-Point Derived Preference (XP): 10 points are added to the passing test score or rating of a spouse who is still alive or the mother of a former spouse. Both the mother and the spouse (including the spouse who is still alive) may be eligible for service-based preference if they both meet the requirements.

Tax Breaks For Disabled Veterans And Surviving Dependents

However, both may not receive preference if former veterans are living and qualify for federal employment. Free Texas Parklands Disabled Passport: The State of Texas offers a Parklands Disabled Veteran's Passport for eligible disabled veterans that allows free admission for a veteran and one other person to all Texas parks.

. Who is eligible for a free Texas Parklands disabled pass? Veterans with a service-connected disability rating of at least 60% or a minimally invasive loss are eligible. They do not have to be Texas residents to be eligible.

Former students must provide one of the following passport documents to obtain a passport: Texas Tuition Voucher Program "TAPS": Students in grades 6 through 12 or in a post-secondary school will receive a voucher. สับติต่า 25 ตั้น ตั้น ตั้น สับติต "Taps" during the honor of the military funeral.

Texas Veterans Affairs Commission, taps certification

Veteran Driver Benefits

texas military retiree benefits, benefits for veterans in texas, texas va disability benefits, list of military benefits, texas va benefits, texas benefits for 100% disabled vets, military veteran benefits in texas, texas state active duty benefits

Source: blog.militaryshop.com.au

Source: blog.militaryshop.com.au USA SOFREP provides daily news and intel brought to you by former US special operations, intelligence and military personnel.

USA SOFREP provides daily news and intel brought to you by former US special operations, intelligence and military personnel. Source: wwwassets.rand.org

Source: wwwassets.rand.org San Antonio, Texas, USA Coffee or Die Magazine is an online news and lifestyle magazine for the military, veteran, first responder and coffee enthusiast community.

San Antonio, Texas, USA Coffee or Die Magazine is an online news and lifestyle magazine for the military, veteran, first responder and coffee enthusiast community. Tucker, Georgia, USA Defense Talk is your complete source for international defense, military and strategic news and information. defensetalk.com 18.5K⋅ 7.9K ⋅4 posts/quarter ⋅ June 2003 Email Contact

Tucker, Georgia, USA Defense Talk is your complete source for international defense, military and strategic news and information. defensetalk.com 18.5K⋅ 7.9K ⋅4 posts/quarter ⋅ June 2003 Email Contact  Source: media.cnn.com

Source: media.cnn.com Canada The mission of the Royal Canadian Air Force is to create and maintain a combat-capable, multi-role, air force to meet Canada's defense objectives. An advanced and professional

Canada The mission of the Royal Canadian Air Force is to create and maintain a combat-capable, multi-role, air force to meet Canada's defense objectives. An advanced and professional

Military noise support for active duty military. Military "width="125" height="125" scale="2"> Military Noise supports soldiers and veterans covering a range of military topics from military history, education, gear noise and retirement. Support. We also offer readers the opportunity to contribute your own stories to the site. Email Militaryshout.com Contact

Military noise support for active duty military. Military "width="125" height="125" scale="2"> Military Noise supports soldiers and veterans covering a range of military topics from military history, education, gear noise and retirement. Support. We also offer readers the opportunity to contribute your own stories to the site. Email Militaryshout.com Contact  Source: cdngallery.adonismale.com

Source: cdngallery.adonismale.com Tactical Gear offers you a variety of tactical military suits, uniforms, pants, shirts

Tactical Gear offers you a variety of tactical military suits, uniforms, pants, shirts " alt="IISS" Defense Technology "width="125" height="125" scale="2"> London, England, UK IISS brings you news and reports on the latest developments in defense technology and provides insight into the security sector. It does. For 60 years, the International Institute for Strategic Studies (IISS) has helped shape the strategic agenda of governments, businesses, media and experts around the world. iiss.org/topics/de.. 64.1K⋅ 182.3

" alt="IISS" Defense Technology "width="125" height="125" scale="2"> London, England, UK IISS brings you news and reports on the latest developments in defense technology and provides insight into the security sector. It does. For 60 years, the International Institute for Strategic Studies (IISS) has helped shape the strategic agenda of governments, businesses, media and experts around the world. iiss.org/topics/de.. 64.1K⋅ 182.3 The US Defense Blog is your insider on military vehicles and equipment. Your trusted source of news for the military community and what's happening overseas.

The US Defense Blog is your insider on military vehicles and equipment. Your trusted source of news for the military community and what's happening overseas. Source: www.leadingauthorities.com

Source: www.leadingauthorities.com Independent opinion on almost anything and everything related to defense, intelligence, politics and national security. formerspook.blogsp.. Email Contact

Independent opinion on almost anything and everything related to defense, intelligence, politics and national security. formerspook.blogsp.. Email Contact  of Defense | Netherlands" width="125" height="125" scale="2"> Netherlands Zuid-Holland den Haag in the Ministry of Defense of the Netherlands. english.defensie.nl 29.5K⋅ 12.4K⋅ 24.6K ⋅1 post/week email contact It goes without saying that Military OneSource goes above and beyond and proudly provides relevant and insightful content for families, friends and soldiers who give

of Defense | Netherlands" width="125" height="125" scale="2"> Netherlands Zuid-Holland den Haag in the Ministry of Defense of the Netherlands. english.defensie.nl 29.5K⋅ 12.4K⋅ 24.6K ⋅1 post/week email contact It goes without saying that Military OneSource goes above and beyond and proudly provides relevant and insightful content for families, friends and soldiers who give Washington Tacoma The military leader has 16 years of experience and four deployments to Iraq/Afghanistan hosting Army infantry. He has been a student of leadership for twenty years, designing "The Military Leader" to help other leaders develop themselves and grow their organizations.

Washington Tacoma The military leader has 16 years of experience and four deployments to Iraq/Afghanistan hosting Army infantry. He has been a student of leadership for twenty years, designing "The Military Leader" to help other leaders develop themselves and grow their organizations. Serious thinking about war and warfare by a lifelong professional soldier, student of the Middle East, and obsessive gamer.

Serious thinking about war and warfare by a lifelong professional soldier, student of the Middle East, and obsessive gamer.

Source: data.militaryembedded.com

Source: data.militaryembedded.com London, UK Covers the latest stories on UK land defense technology, military vehicles, military armour, robotics and global warfare and security trends. Army-Technology on the Army Blog.

London, UK Covers the latest stories on UK land defense technology, military vehicles, military armour, robotics and global warfare and security trends. Army-Technology on the Army Blog. New York City, New York, USA Live Science Science, Space, Technology, Health, Our Environment ਬੁਨਿਆਦੀ ਵਿਕਾਸ ਨੂੰ ਕਵਰ ਕਰਦਾ ਹੈ , ਸੱਭਿਆਚਾਰ, ਅਤੇ ਇਤਿਹਾਸ. livecience.com/to .. 1.3M⋅ 403.6K ⋅6 ਪੋਸਟਾਂ/ਸਾਲ ⋅ ਜਨਵਰੀ 2004 ਈਮੇਲ ਸੰਪਰਕ

New York City, New York, USA Live Science Science, Space, Technology, Health, Our Environment ਬੁਨਿਆਦੀ ਵਿਕਾਸ ਨੂੰ ਕਵਰ ਕਰਦਾ ਹੈ , ਸੱਭਿਆਚਾਰ, ਅਤੇ ਇਤਿਹਾਸ. livecience.com/to .. 1.3M⋅ 403.6K ⋅6 ਪੋਸਟਾਂ/ਸਾਲ ⋅ ਜਨਵਰੀ 2004 ਈਮੇਲ ਸੰਪਰਕ

Source: s17189.pcdn.co

Source: s17189.pcdn.co Source: upload.wikimedia.org

Source: upload.wikimedia.org Source: www.militarytime.us

Source: www.militarytime.us Source: images.theconversation.com

Source: images.theconversation.com Source: www.whs.mil

Source: www.whs.mil

Source: i.pinimg.com

Source: i.pinimg.com Source: monochrome-watches.com

Source: monochrome-watches.com Source: i.etsystatic.com

Source: i.etsystatic.com Source: cdn.shopify.com

Source: cdn.shopify.com Source: www.dalucastraps.com

Source: www.dalucastraps.com